Locking Up Profits in Private Prisons

by Rich Duprey - August 25, 2009 - 0 comments

The reports were chilling. Some 1,300 inmates in seven barracks rioted in

Chino's California Institution for Men, setting fire to the facility and

injuring 250 prisoners earlier this month.

Kentucky's medium-security Northpoint Training Center suffered a similar

fiery melee just last week. Our prisons are bursting at the seams,

overcrowded to the point of instability. But a private solution may help

ease this crisis -- and offer investors an opportunity to profit.

Prisons on lockdown

With 158,000 inmates, California's prisons are recognized as the nation's

most overcrowded. Los Angeles County has the largest daily jail

population, ahead of Harris County, Texas, and even New York City.

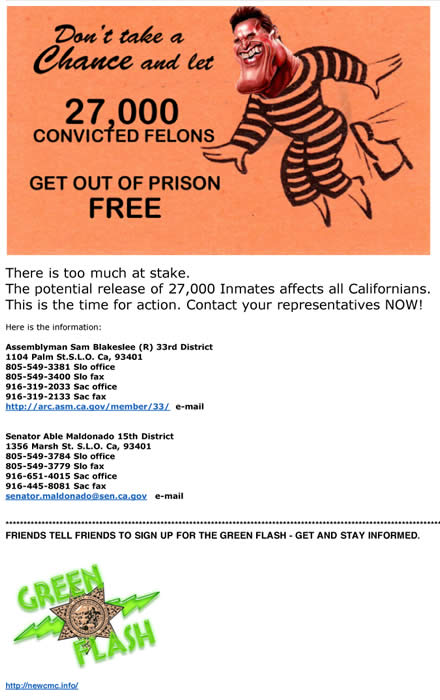

Federal judges recently ruled that the state must reduce its inmate count

by 43,000 over the next two years.

California isn't alone. One in every 31 adults in the U.S. is either in

federal, state, or local prison, or is being monitored on probation or

parole. The U.S. has the world's largest prison population, with the

federal prison system was operating 36% above its capacity at the end of

2007. The situation at Chino was even worse: 5,900 prisoners were housed

in a facility meant for 3,000.

Unfortunately, crime will always be with us, and criminals will need to be

housed. That's usually meant that governments construct and run new

prisons. State spending on corrections increased 300% over the past two

decades, but when states like California are facing bankruptcy, it's not

feasible to expect them to finance more construction.

Instead, we may see them turn to private correction and detention

facilities in greater numbers, like those run by Corrections Corp of

America (NYSE: CXW), Cornell Companies (NYSE: CRN), Geo Group (NYSE: GEO),

and G4S.

Corrections Corp of America is the country's largest private prison

operator, with 65 jails and detention facilities in 19 states. Its

facilities have a capacity for 86,500 inmates and typically operate at

more than 95% of capacity. In fact, only the federal government and three

states run bigger prison systems. CCA generated 45% of its total revenue

of nearly $1.6 billion from state contracts in 2008 (and 39% from federal

contracts). Geo Group, the second-largest operator, had $711 million in

U.S. revenue. No. 3 Cornell had $386.7 million in total 2008 revenue.

Manhunt for value

Crime remains a growth industry, but the correction industry has enjoyed

some phenomenal growth, too, which ought to seize investors' enthusiasm.

CCA shares have almost doubled over the past six months, while Geo is up

44% and Cornell 43%. Yet all are trading at or below their five-year

average market multiples.

With favorable industry demographics for the long term, analysts expect

CCA and Cornell to grow by 11% and 12% per year over the next five years,

respectively. They foresee Geo Group growing at a more robust 16% clip per

year. This gives Geo Group a PEG ratio of 0.85, lower than the 1.52 for

CCA and the 1.02 for Cornell. All three companies are well below the S&P

500's 2.1 average.

These private jailers look tempting, particularly in relation to industry

trends. Private prisons housed 7.8% of the country's 1.61 million

incarcerated adults in federal and state prisons as of the middle of 2008,

up from 7.4% in 2007, according to the Bureau of Justice Statistics. With

the U.S. expecting more than 1.7 million men and women in prison by 2011

(a 13% jump from 2007, according to a study by the Pew Center on the

States), the growing cost of those incarcerations may force states to

increasingly turn to private companies. By outsourcing incarceration

services, a government could reduce the cost of housing those prisoners by

10% to 20%.

The big breakout

A difficult recession; budgetary constraints by local, state, and federal

authorities; no end to the supply of "guests;" and cost savings offered by

the for-profit proprietors all point to the possibility that investors

could lock up good, long-term returns with these companies.

While CCA, as the Big House of the three, ought to command a premium for

its shares, I find Geo Group the most attractive right now. Its financials

offer comparable metrics at a better price. Geo has a strong balance

sheet, and while its operating margin isn't as good as CCA's, Geo Group

has enjoyed superior compounded revenue growth over the past five years.

If I were to make a break for it with just one private jailer today, it

would be Geo Group. Head over to Motley Fool CAPS and take a peek at what

other Fools think about the company; it could make a worthy inmate in your

portfolio.

Copyright 2009 by United Press International.

![]()

No comments:

Post a Comment